Washington and Tokyo are edging toward a partial reset on trade. The clearest movement is in the automotive sector, where the United States has lowered tariffs on Japanese automobiles and auto parts to a 15 percent baseline. That change offers relief after months of uncertainty and a punishing period of higher levies, but the broader deal remains unfinished. Japan’s lead negotiators have been explicit: the agreement is not settled until the White House issues the expected presidential orders clarifying treatment for pharmaceuticals and semiconductors. Until those orders arrive, two of the most strategically important sectors in the modern economy remain in limbo.

Below is a deep dive into what has changed, what still has not, and how this matters for manufacturers, patients, and consumers on both sides of the Pacific.

What Changed Right Now: Autos Move, Fast

In late summer 2025, the United States formalized a move to cut the tariff on Japanese cars and parts from the peak rates set earlier this year to a 15 percent baseline. That rate is still far higher than the pre-2025 norm for most Japanese passenger vehicles entering the U.S. market, but it is a substantial reduction from the 27.5 percent headline figure that had snarled planning across the supply chain.

For Japanese automakers, the immediate effect is operational breathing room. Finance teams can reopen stalled pricing models. Logistics teams can normalize shipping schedules that had been held back by tariff uncertainty. U.S. dealers, who had been juggling thin inventories in popular segments, can begin to forecast availability with more confidence for the fourth quarter and beyond. The 15 percent baseline does not eliminate all pain, but it sharply narrows the band of risk that executives had been modeling since the midsummer shock.

Three short-term implications stand out:

-

Pricing posture softens: With a known 15 percent tariff cost, automakers can calibrate transaction prices and incentive support without guessing which duty will apply on arrival. Expect a staggered pass-through, varying by segment and model mix.

-

Model prioritization shifts: Exporters are likely to emphasize higher-margin vehicles that can absorb the 15 percent hit more easily while continuing to localize production of mass-market nameplates where feasible.

-

Parts and aftermarket stabilize: The parts tariff cut matters for service networks. Dealers and independent repair shops can reassess inventories and labor scheduling as parts flow steadies and cost inflation eases.

What Has Not Changed: Pharma and Semiconductors Await Orders

Despite the automotive move, Japan’s negotiators have been clear that the broader trade package is not complete. The missing pieces are presidential orders covering pharmaceuticals and semiconductors. Those orders would determine tariff treatment and, potentially, confirm most-favored-nation style assurances for two sectors that sit at the heart of national resilience.

Why this matters:

-

Pharmaceuticals underpin public health and cost of care. Ambiguity around tariff exposure can ripple into drug pricing strategies, supply security, and investment decisions for clinical manufacturing. The U.S. has explored using tariff leverage to nudge localization and friend-shoring. Japan wants predictability before committing to long-dated capacity plans that integrate tightly with the American market.

-

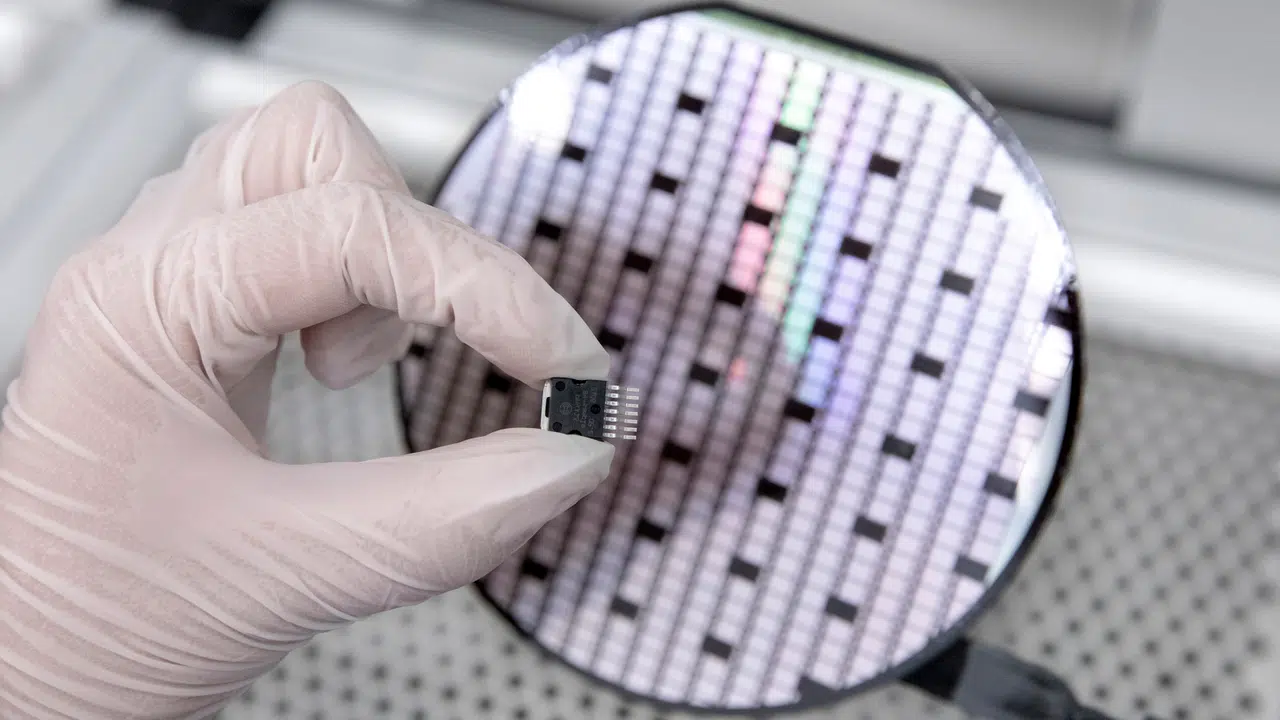

Semiconductors are the nervous system of the modern economy. Japan’s role in upstream equipment, advanced materials, and specialty chips makes tariff signals consequential beyond bilateral trade flows. Clear U.S. orders would help Japanese firms coordinate with CHIPS Act incentives, foundry roadmaps, and export-control compliance without tripping into unexpected tax wedges at the border.

Until the orders are issued, boardrooms will keep contingency plans active. That means slower green-lighting of expansions, more hedging of inventory and currency exposure, and tighter coordination with U.S. customers who need reliable delivery windows for everything from medical devices to AI servers.

The Investment and Industrial Context

Baked into the summer negotiations is a broader industrial logic. The United States wants investment, jobs, and secure supply in strategic sectors. Japan wants dependable access to the American market and clear rules that reward high-standards trade among allies. The result is a package where tariff levels are one lever among many, interacting with investment pledges, market-access adjustments, and sector-specific guardrails.

For autos, the tariff dial just turned to 15 percent and the market is adjusting. For pharma and semiconductors, the policy dial is still pointing at “pending,” and companies are behaving accordingly. The risk, if the impasse lingers, is a two-speed relationship: autos normalize while life sciences and chips drift in uncertainty, raising costs and undercutting the very resilience both governments say they want.

How Automakers Are Recalculating

Automakers are already modeling scenario trees that branch on three variables: tariff permanence, exchange rates, and U.S. demand elasticity.

-

Tariff permanence: If the 15 percent baseline holds through 2026, firms can re-sequence product launches, pull forward trims that hit sweet spots after tariff-adjusted pricing, and schedule overtime at export plants to refill pipeline inventory.

-

FX path: Yen weakness can offset part of the tariff bite, but finance leaders will avoid over-reliance on currency. Expect renewed interest in natural hedges, such as sourcing more components in dollars or expanding U.S. content where it meaningfully reduces exposure.

-

Demand elasticity: A 15 percent tariff is still visible in retail pricing. The question is how much buyers trade down or delay purchases. Early signals will come from cross-shop rates between Japanese brands and Korean, European, and domestic competitors and from lease penetration, which can smooth monthly payments even when MSRP creeps up.

Why the Pharma and Chip Orders Are Hard

Issuing clean, durable orders on pharmaceuticals and semiconductors is challenging because the goals collide:

-

Resilience vs. affordability: Tariffs can encourage domestic and allied investment, but they also risk raising prices for patients and downstream manufacturers in the near term.

-

Security vs. openness: The U.S. wants to de-risk supply chains from geopolitical rivals while maintaining openness with allies. Drawing bright lines that exclude bad actors without penalizing partners requires careful drafting and constant enforcement.

-

Trade policy vs. industrial policy: In chips especially, tariffs intersect with subsidies, tax credits, export controls, and research funding. Japan’s companies sit across that web, from wafer equipment to advanced packaging. The U.S. orders need to slot into this architecture without contradicting it.

What to Watch Next

-

The text of the presidential orders: The exact language will determine whether tariffs are suspended, reduced, or conditioned on investment and compliance benchmarks. Footnotes matter.

-

Sector carve-outs and rules of origin: Expect detailed definitions that separate generic drug inputs from finished formulations, or commodity silicon from advanced nodes, each with different treatment.

-

Reciprocity and dispute mechanisms: Tokyo will seek assurance that any favorable treatment is durable and enforceable. Clarity on review timelines and triggers will shape boardroom confidence.

-

Corporate guidance: Watch automaker and supplier guidance for the next two quarters. If they lift unit or margin outlooks, it signals that the 15 percent baseline is manageable. If they hold back, it suggests lingering caution.

-

Investment announcements: Plant upgrades, packaging lines, and clinical manufacturing expansions often follow policy clarity by a few months. A steady drip of Japan-to-U.S. investment news would indicate momentum.

The Consumer Angle

For U.S. car buyers, the tariff shift will not translate into overnight price cuts. What you are more likely to see is a gradual easing of dealer markups where inventory had been tight, slightly better lease deals on specific trims, and fewer delivery delays for in-demand models. On the pharma side, the goal is to avoid any policy that raises out-of-pocket costs. Clear orders that reinforce reliable, tariff-light access to Japanese inputs and finished products can soften inflation pressures in the drug supply chain.

The Strategic Stakes

This negotiation is not only about near-term import taxes. It is a test of whether two close allies can align trade, investment, and security policy in a world where supply chains are weapons and semiconductors are strategy. A clean landing would show that democracies can protect their industrial bases without blowing up the rules that made them prosperous. A messy outcome would add friction to sectors that should be anchors of cooperation.

Bottom Line

-

Autos: The United States has lowered tariffs on Japanese vehicles and parts to a 15 percent baseline. Relief is real, even if the rate is still higher than the pre-2025 norm. Automakers are recalculating pricing, model mix, and shipment schedules accordingly.

-

Pharma and chips: Japan considers the deal unfinished until the White House issues orders clarifying tariff treatment for pharmaceuticals and semiconductors. Those decisions will shape investment and supply security for years.

-

Next steps: All eyes are on Washington. If the administration locks in clear, favorable rules for medicines and semiconductors, a tentative truce becomes a workable framework. If not, the bilateral trade relationship will run at two speeds, with autos moving forward and strategic tech stuck in neutral.

For now, Tokyo welcomes the automotive relief but is holding its applause until the pharmaceutical and semiconductor pieces are confirmed. The message to markets is simple: the runway is clearing, but the plane has not taken off yet.